QuickLinksSCHEDULE 14A

-- Click here to rapidly navigate through this document(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ||

¨Confidential, | ||

xDefinitive Proxy Statement | ||

¨ Definitive Additional Materials | ||||

¨ Soliciting Material Under Rule 14a-12 | ||||

APOGEE ENTERPRISES, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1. | Title of each class of securities to which transaction applies: |

| Aggregate number of securities to which transaction applies: |

| Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| Proposed maximum aggregate value of transaction: |

| Total fee paid: |

¨ Fee paid previously with preliminary materials:

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the |

| Amount previously paid: |

| Form, Schedule or Registration Statement No.: |

| Filing Party: |

| Date Filed: |

May 8, 20029, 2003

Dear Shareholder:

You are cordially invited to attend the 20022003 Annual Meeting of Shareholders of Apogee Enterprises, Inc. to be held in the Lutheran BrotherhoodThrivent Financial Building Auditorium, 625 Fourth Avenue South, Minneapolis, Minnesota, commencing at 10:00 a.m. Central Daylight Time on Tuesday, June 18, 2002.17, 2003.

The Secretary'sSecretary’s formal notice of the meeting and the proxy statement appear on the following pages and describe the matters to come before the meeting. During the meeting, time will be provided for a review of the activities of the past year and items of general interest about the Company.Apogee.

As a convenience to shareholders unable to attend the annual meeting in person, we also will be webcasting the meeting. To view the meeting via webcast, go to the Company'sour web site athttp://www.apog.comand click on the "investor relations"“investor relations” button, followed by the webcast link at the top of that page. Please plan to be aton the web site at least 15 minutes prior to the meeting so that you have sufficient time to register and to download and install any necessary software.

We hope that you will be able to attend the meeting in person, and we look forward to seeing you. Even if you plan to attend the meeting in person, we urge you to vote your shares by marking your votes on the enclosed proxy card, signing and dating it, and mailing it in the enclosed postage-paid envelope as promptly as possible. You also may vote your shares by telephone or Internet as directed on the enclosed proxy card. Telephone and Internet voting facilities for shareholders of record will be available 24 hours a day, and will close at 5:00 p.m. Eastern Daylight Time (4:00 p.m. Central Daylight Time) on June 17, 2002.16, 2003. If you do attend the meeting in person, you may at that time revoke any proxy previously given and vote in person, if desired.

Sincerely,

Russell Huffer

Chairman, President and

Chief Executive Officer

APOGEE ENTERPRISES, INC.

7900 Xerxes Avenue South

Suite 1800

Minneapolis, MN 55431-1159

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

to be held on June 18, 2002

17, 2003

NOTICE IS HEREBY GIVEN that the 20022003 Annual Meeting of Shareholders of Apogee Enterprises, Inc. (the "Company") will be held in the Lutheran BrotherhoodThrivent Financial Building Auditorium, 625 Fourth Avenue South, Minneapolis, Minnesota, commencing at 10:00 a.m. Central Daylight Time on Tuesday, June 18, 200217, 2003 for the following purposes:

| 1. | To elect three Class II directors for three-year terms ending in the year 2006; |

| 2. | To consider and act upon a proposal to amend the Amended and Restated 1987 Apogee Enterprises, Inc. Partnership Plan; |

| 3. | To ratify the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending February 28, 2004; and |

| 4. | To transact such other business as may properly be brought before the meeting. |

The Board of Directors has fixed April 24, 200223, 2003, as the record date for the meeting. Only shareholders of record at the close of business on that date are entitled to receive notice of and to vote at the meeting.

As a convenience to shareholders unable to attend the annual meeting in person, we also will be webcasting the meeting. To view the meeting via webcast, go to the Company'sour web site athttp://www.apog.comand click on the "investor relations"“investor relations” button, followed by the webcast link at the top of that page. Please plan to be aton the web site at least 15 minutes prior to the meeting so that you have sufficient time to register and to download and install any necessary software.

Your vote is important to ensure a quorum at the meeting. Even if you own only a few shares, and whether or not you expect to be present at the meeting, we urgently request that you to mark, date, sign and mail the enclosed proxy card in the postage-paid envelope provided or vote your shares by telephone or Internet as directed on the enclosed proxy card. Telephone and Internet voting facilities for shareholders of record will be available 24 hours a day, and will close at 5:00 p.m. Eastern Daylight Time (4:00 p.m. Central Daylight Time) on June 17, 2002. The16, 2003. You may revoke your proxy may be revoked by you at any time prior to the meeting and delivery of your proxy will not affect your right to vote in person if you attend the meeting.

By Order of the Board of Directors,

Patricia A. Beithon

General Counsel and Secretary

Minneapolis, Minnesota

May 8, 20029, 2003

APOGEE ENTERPRISES, INC.

PROXY STATEMENT

The enclosed proxy is being solicited on behalf

i

24 | ||

24 | ||

Audit Fees, Financial Information Systems Design and Implementation Fees and All Other Fees | 26 | |

26 | ||

PROPOSAL 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | 26 | |

27 | ||

27 | ||

28 | ||

A-1 |

ii

PROXY STATEMENT

2003 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 17, 2003

The Board of Directors of Apogee Enterprises, Inc. (the "Company")is soliciting proxies for use at our 2002 Annual Meetingannual meeting of Shareholdersshareholders to be held on June 18, 2002. The cost17, 2003, and at any adjournment of soliciting proxiesthe meeting. This proxy statement and the enclosed proxy card are first being mailed or given to shareholders on or about May 14, 2003.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the purpose of the meeting?

At our annual meeting, shareholders will be paid byact upon the Company. In additionmatters outlined in the Notice of Annual Meeting of Shareholders. These include the election of directors, approval of an amendment to solicitation by mail, somethe Amended and Restated 1987 Apogee Enterprises, Inc. Partnership Plan and ratification of the appointment of our officersindependent auditors. Also, management will report on our performance during the last fiscal year and regular employees may solicitrespond to questions from shareholders.

Who is entitled to vote at the returnmeeting?

The Board of proxies by telephone, telegram, facsimile or personal interview but will receive no special compensationDirectors has set April 23, 2003, as the record date for these services. Additionally, we may request brokerage houses and custodians, nominees and fiduciaries to forward soliciting materials to their principals, in which case we will reimburse them for their reasonable out-of-pocket expenses.

Only shareholdersthe annual meeting. If you were a shareholder of record at the close of business on April 24, 2002 will be23, 2003, you are entitled to notice of and to vote at the annual meeting. A

As of the record date, 27,457,625 shares of common stock, par value $.33-1/3, were issued and outstanding and, therefore, eligible to vote at the annual meeting.

Holders of our common stock are entitled to one vote per share. Therefore, a total of 27,457,625 votes are entitled to be cast at the meeting. There is no cumulative voting.

How many shares must be present to hold the meeting?

In accordance with our bylaws, shares equal to at least a majority of the voting power of the outstanding shares of our common stock as of the record date must be present at the meeting in order to hold the meeting and conduct business. This is called a quorum. Shares are counted as present at the meeting if:

| Ÿ | you are present and vote in person at the meeting; or |

| Ÿ | you have properly submitted a proxy by mail, telephone or Internet. |

If you are a shareholder executingof record, you can give a proxy retainsto be voted at the right to revoke the proxy by noticemeeting in writing to the Secretaryany of the Company at any time priorfollowing ways:

| Ÿ | by telephone, by calling a toll-free number; |

| Ÿ | electronically, using the Internet; or |

| Ÿ | by completing, signing and mailing the enclosed proxy card. |

The telephone and Internet voting procedures have been set up for your convenience. The procedures have been designed to its use, by filingauthenticate your identity, to allow you to give voting instructions, and to confirm that those instructions have been recorded properly. If you are a duly executed proxy bearing a later date with the Secretaryshareholder of the Company, by submitting a newrecord and you would like to submit your proxy by telephone or throughInternet, please refer to the Internet or by revokingspecific instructions provided on the enclosed proxy atcard. If you wish to vote using a paper format, please return your signed proxy card before the annual meeting and votingmeeting.

If you hold your shares in person. Proxiesstreet name, you must vote your shares in the accompanying form which aremanner prescribed by your broker or other nominee. Your broker or other nominee has enclosed or otherwise provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares.

If you properly executed,execute, duly returnedreturn and do not revokedrevoke your proxy, it will be voted in the manner specified. you specify.

What is the difference between a shareholder of record and a “street name” holder?

If your shares are registered directly in your name, you are considered the shareholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the shareholder of record with respect to those shares. However, you still are considered the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the method described on page 1 under “How do I vote my shares?”

How do I vote if my shares are held in the 401(k) retirement plan, employee stock purchase plan or other plans of Apogee?

If you hold any shares in our 401(k) retirement plan, employee stock purchase plan or other plans of Apogee, your completed proxy card or telephone or Internet proxy vote will serve as voting instructions to the plan trustee. However, your voting instructions must be received at least one day prior to the annual meeting in order to count. In accordance with the terms of our 401(k) retirement plan, the trustee will vote all of the shares held in the plan in the same proportion as the actual proxy votes submitted by plan participants at least one day prior to the annual meeting. If you are a participant in our employee stock purchase plan, the plan custodiancannot vote your shares unless it receives timely instructions from you.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it means that you hold shares registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit your proxy vote by telephone or Internet, vote once for each proxy card you receive.

You may prefer to hold your shares in more than one account, and you are welcome to do so. However, some multiple accounts are unintentional and will occur if one stock purchase is made with a middle initial and a subsequent purchase is made without a middle initial. Please contact our Investor Relations Department at IR@apog.com, (952) 896-2422 (phone) or (952) 896-2400 (fax) for information on how to merge accounts.

Can I vote my shares in person at the meeting?

If you are a shareholder of record, you may vote your shares in person at the meeting by completing a ballot at the meeting. Even if you currently plan to attend the meeting, we recommend that you also submit your proxy as described above so that your vote will be counted if you later decide not to attend the meeting.

If you are a street name holder, you may vote your shares in person at the meeting only if you obtain a signed letter or other proxy from your broker or other nominee giving you the right to vote the shares at the meeting.

If you are a participant in our 401(k) retirement plan, employee stock purchase plan or other plans of Apogee, you may submit a proxy vote as described above, but you may not vote your plan shares in person at the meeting.

What vote is properly executed but does not specify anyrequired for the election of directors or all choices on it, the proxy willfor a proposal to be voted as follows: (a) in favorapproved?

The affirmative vote of a majority of the shares of our common stock present in person or by proxy and entitled to vote at the annual meeting is required for the election as Class I directors of the three nominees described in this proxy statement; (b) in favor ofeach director and for the approval of the Apogee Enterprises, Inc. 2002 Omnibus Stock Incentive Plan; (c) in favor of the approval of the Apogee Enterprises, Inc. Executive Management Incentive Plan; (d) in favor of the ratification of the appointment of Deloitte & Touche LLP as independent auditors of the Company; and (e) in the discretion of the persons named in the proxy, as to such other matters as may properly come before the meeting and as to which we did not have knowledge prior to February 19, 2002.each proposal.

You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the Board of Directors. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the other proposals.

If an executedyou submit your proxy is returned and the shareholder has voted "withhold"but abstain from voting or "abstain" on any matter, the shares represented by such proxy will be considered present at the meeting for purposes of determining a quorum and for purposes of calculating the vote with respect to such matter, but will not be considered to have been voted in favor of the matter. If an executed proxy is returned by a broker holding shares in street name which indicates that the broker does not have discretionarywithhold authority as to specified shares to vote on one or more matters, suchyour shares will be counted as present at the meeting for the purpose of determining a quorum. Your shares also will be counted as present at the meeting for the purpose of calculating the vote on the particular matter with respect to which you abstained from voting or withheld authority to vote.

If you abstain from voting on a proposal, your abstention has the same effect as a vote against that proposal. If you withhold authority to vote for one or more of the directors, this has the same effect as a vote against those directors.

If you hold your shares in street name and do not provide voting instructions to your broker, your shares will be considered representedto be “broker non-votes” and will not be voted on any proposal on which your broker does not have discretionary authority to vote. Shares that constitute broker non-votes will be counted as present at the meeting for purposesthe purpose of determining a quorum but not be represented at the meeting for purposes of calculating the vote with respect to such matter or matters. This effectively reduces the number of shares needed to approve such matter or matters.

Our address

How does the Board of Directors recommend that I vote?

The Board of Directors recommends a vote:

| Ÿ | FOR all of the nominees for director; |

| Ÿ | FOR the proposal to amend the Amended and Restated 1987 Apogee Enterprises, Inc. Partnership Plan; and |

| Ÿ | FOR the ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending February 28, 2004. |

What if I do not specify how I want my shares voted?

If you submit a signed proxy card or submit your proxy by telephone or Internet and do not specify how you want to vote your shares, we will vote your shares:

| Ÿ | FOR all of the nominees for director; |

| Ÿ | FOR the proposal to amend the Amended and Restated 1987 Apogee Enterprises, Inc. Partnership Plan; |

| Ÿ | FOR the ratification of the appointment of Deloitte & Touche LLP as our independent auditors for the fiscal year ending February 28, 2004; and |

| Ÿ | in the discretion of the persons named in the proxy on any other matters that properly come before the meeting and as to which we did not have knowledge prior to February 18, 2003. |

Can I change my vote after submitting my proxy or voting instructions?

Yes. If you are a shareholder of record, you may revoke your proxy and change your vote at any time before your proxy is 7900 Xerxes Avenue South, Suite 1800, Minneapolis, Minnesota 55431-1159. Ourvoted at the annual meeting, in any of the following ways:

| Ÿ | by sending a written notice of revocation to our Secretary; |

| Ÿ | by submitting a later-dated proxy to our Secretary; |

| Ÿ | by submitting a later-dated proxy by telephone or Internet; or |

| Ÿ | by voting in person at the meeting. |

If you hold your shares in street name, you should contact your broker or other nominee for information on how to revoke your voting instructions and provide new voting instructions.

If you hold shares in our 401(k) retirement plan, employee stock purchase plan or other plans of Apogee, you may revoke your proxy and change your vote at any time but not less than one day before the annual meeting, in any of the following ways:

| Ÿ | by sending a written notice of revocation to the plan trustee or plan custodian; |

| Ÿ | by submitting a later-dated proxy or voting instruction to the plan trustee or plan custodian; or |

| Ÿ | by submitting a later-dated proxy or voting instructions by telephone or Internet. |

Will my vote be kept confidential?

Yes. We have procedures to ensure that, regardless of whether shareholders vote by mail, telephone, number is (952) 835-1874. The mailingInternet or in person, (1) all proxies, ballots and voting tabulations that identify shareholders are kept permanently confidential, except as disclosure may be required by federal or state law or expressly permitted by a shareholder; and (2) voting tabulations are performed by an independent third party.

You may be asked to present valid picture identification, such as a driver’s license or passport, before being admitted to the meeting. If you hold your shares in street name, you may also be asked to present proof of this proxyownership to be admitted to the meeting. A recent brokerage statement and formor letter from your broker or other nominee are examples of proof of ownership.

Who pays for the cost of proxy preparation and solicitation?

We pay for the cost of proxy preparation and solicitation, including the reasonable charges and expenses of brokers and other nominees for forwarding proxy materials to the beneficial owners of the shares.

We are soliciting proxies primarily by mail. In addition, some of our officers and regular employees may solicit the return of proxies by telephone, facsimile, personal interview, e-mail or telegram. These individuals will commence on or about May 14, 2002.receive no additional compensation for these services.

The following table sets forth information concerning beneficial ownership of our common stock

SECURITY OWNERSHIP OF PRINCIPAL SHAREHOLDERS At April 24, 2002, 28,339,814 shares of our common stock, par value $.331/3, were issued and outstanding. Each share is entitled to one vote. of the Company by persons who are known byto us to own more than five percent of our common stock outstanding as of March 31, 2002,April 23, 2003, except as noted below. Unless otherwise indicated, the named holders have sole voting and investment power with respect to the shares beneficially owned by them.

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (#) | % of Class | ||

|---|---|---|---|---|

| Putnam Investments, LLC(1) One Post Office Square Boston, MA 02109 | 2,487,760 | 8.8 | ||

Dimensional Fund Advisors Inc.(2) 1299 Ocean Avenue, 11th Floor Santa Monica, CA 90401 | 2,287,866 | 8.1 | ||

Trust of Russell H. Baumgardner(6/6/86)(3) 607 Mountain Links Drive Henderson, NV 89012 | 1,978,645 | 7.0 | ||

State Street Bank and Trust Company(4) 225 Franklin Street Boston, MA 02110 | 1,514,893 | 5.3 |

Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership (#) | % of Common Stock Outstanding | ||

Putnam LLC, d/b/a Putnam Investments(1) | 2,736,396 | 10.0 | ||

Trust of Russell H. Baumgardner(6/6/86)(2) | 1,773,388 | 6.5 | ||

Dimensional Fund Advisors Inc.(3) | 1,753,366 | 6.4 | ||

State Street Bank and Trust Company(4) | 1,496,998 | 5.5 |

2

| (1) | We have relied upon the information supplied by Putnam LLC, d/b/a Putnam Investments, in a Schedule 13G furnished to us reporting information as of December 31, 2002. Putnam serves as the sub-advisor and the investment manager of various mutual funds that hold the shares of our common stock in the ordinary course of business. In these capacities, Putnam exercises shared investment power over various institutional accounts that held, in the aggregate, 2,736,396 shares of our common stock as of December 31, 2002. Of the shares reported, Putnam has shared voting power with respect to 810,300 shares and shared investment power with respect to 2,736,396 shares. |

| (2) | We have relied upon the information regarding the Russell H. Baumgardner Trust dated June 6, 1986 supplied by the trustees of the Trust and our transfer agent as of April 23, 2003. The 1,773,388 shares held by the Trust are also deemed to be beneficially owned by Messrs. Donald W. Goldfus, O. Walter Johnson and Laurence J. Niederhofer, who serve as trustees of the Trust, because as trustees, they share voting and investment power over the shares. If the shares held by the Trust were included in the holdings of Messrs. Goldfus, Johnson and Niederhofer, these individuals’ common stock holdings would be as follows: Mr. Goldfus, 2,445,780 (8.9%), Mr. Johnson, 1,773,388 (6.5%), and Mr. Niederhofer, 2,235,608 (8.1%). |

| (3) | We have relied upon the information supplied by Dimensional Fund Advisors Inc. in a Schedule 13G furnished to us reporting information as of December 31, 2002. Dimensional serves as the investment advisor to four investment companies and the investment manager to other commingled group trusts and separate accounts that hold the shares of our common stock in the ordinary course of business. In these capacities, Dimensional possesses sole voting and investment power over, in the aggregate, 1,753,366 shares of our common stock held by such group trusts and separate accounts as of December 31, 2002. Dimensional disclaims beneficial ownership of the shares. |

| (4) | We have relied upon the information supplied by State Street Bank and Trust Company in a Schedule 13G furnished to us reporting information as of December 31, 2002. State Street serves as trustee for our retirement plan that holds the shares of our common stock in the ordinary course of business. In this capacity, State Street exercises sole voting power with respect to 554,133 shares, shared voting power with respect 895,165 shares, sole investment power with respect to 1,496,898 shares and shared investment power with respect to 100 shares. |

Our executive officers and directors are encouraged to own Apogee common stock to further align their interests with those of our shareholders. We established voluntary stock ownership guidelines for our executive officers in 2001 and for our directors in 2002. The guidelines encourage share ownership by our executive officers and directors in an amount having a market value of a multiple of the individual’s annual base salary, in the case of our executive officers, or annual retainer, in the case of our directors, to be achieved within five years of becoming an executive officer or director. The following table sets forth the number of shares of our common stock beneficially owned Amount and Nature of Beneficial Ownership Name of Beneficial Owner Shares of Common Stock Held (#)(1) Shares Underlying Options Exercisable Within 60 Days (#)(2) Phantom Stock Units (#)(3) Total (#) % of Common Stock Outstanding Bernard P. Aldrich 1,000 20,574 4,618 26,192 * Patricia A. Beithon 81,908 21,250 — 103,158 * Michael B. Clauer 60,060 44,344 — 104,404 * Joseph T. Deckman 145,827 143,250 — 289,077 1.0 Robert L. Edwards 10,000 — — 10,000 * Donald W. Goldfus 495,992 (4)(5) 176,574 — 672,566 2.4 Barbara B. Grogan 4,132 28,574 — 32,706 * Harry A. Hammerly 18,287 38,954 — 57,241 * J. Patrick Horner 10,773 24,574 15,043 50,390 * Russell Huffer 212,736 (6) 281,525 — 494,261 1.8 James L. Martineau 237,964 20,574 — 258,538 * Stephen C. Mitchell 8,132 28,574 — 36,706 * Laurence J. Niederhofer 420,914 (5)(7) 41,306 — 462,220 1.7 Ray C. Richelsen — 16,574 2,331 18,905 * Michael E. Shannon 2,000 28,574 13,239 43,813 * Larry D. Stordahl 84,852 (8) 95,000 — 179,852 * All directors and executive officers 1,853,789 (5) 1,047,572 35,231 2,936,592 10.3business. In this capacity, State Street exercises sole voting power with respect to 593,337 shares, shared voting power with respect to 895,956 shares, sole investment power with respect to 1,514,793 shares and shared investment power with respect to 100 shares.

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERSat March 31, 2002as of April 23, 2003, by each of our directors, each of ourdirector nominees and executive officers named in the Summary Compensation Table included in this Proxy Statementon page 16 under the caption "Executive Compensation" below,“Executive Compensation,” and by all of our directors and executive officers as a group. Amount and Nature of Beneficial Ownership Name Number of

Shares Held

(#)(1) Options

Exercisable

Within 60 Days

(#)(1) Phantom

Stock

Units (#)(2) Total (#) % of

Outstanding

Shares Bernard P. Aldrich 1,000 12,000 762 13,762 (3 ) Patricia A. Beithon 40,990 10,000 — 50,990 (3 ) Michael B. Clauer 14,265 20,000 — 34,265 (3 ) Joseph T. Deckman 114,560 130,000 — 244,560 (3 ) Donald W. Goldfus 630,555 (4)(5) 168,000 — 798,555 2.8 Barbara B. Grogan 3,455 20,000 — 23,455 (3 ) Harry A. Hammerly 16,967 30,380 — 47,347 (3 ) J. Patrick Horner 10,757 16,000 13,798 40,555 (3 ) Russell Huffer 122,614 297,500 — 420,114 1.5 James L. Martineau 235,173 12,000 — 247,173 (3 ) Stephen C. Mitchell 7,455 20,000 — 27,455 (3 ) Laurence J. Niederhofer 426,981 (5)(6) 32,732 — 459,713 1.6 Ray C. Richelsen — 8,000 — 8,000 (3 ) Michael E. Shannon 2,000 20,000 11,330 33,330 (3 ) Larry D. Stordahl 44,667 (7) 60,000 — 104,667 (3 ) All Directors and Executive Officers as a Group (17 persons) 1,694,757 882,987 25,890 2,603,634 8.9

as a group (18 persons) (1)* Indicates less than 1%. (1) Unless otherwise indicated, the individuals listed in the table have sole voting and investment power with respect to the shares owned by them. The number of shares indicated includes shares issued pursuant to our 1987 Partnership Plan, our employee stock purchase plan, our 401(k) savings plan and our defined contribution pension plan. The number of stock options indicated are exercisable currently or within 60 days of March 31, 2002.(2)Phantom stock units, each representing the value of one share of our common stock, are attributable to accounts in our Deferred Compensation Plan for Non-Employee Directors. The participants in the plan do not have voting or investment power with respect to these units.(3)Less than 1%.(4)Includes 120,000 shares held by Mr. Goldfus' wife, as to which he disclaims beneficial ownership.(5)Shares held by the Russell H. Baumgardner Trust dated June 6, 1986 are deemed to be beneficially owned by Messrs. Goldfus and Niederhofer because they share voting and investment power with respect to the shares owned by them. The number of shares indicated includes shares issued to the named individual pursuant to our Amended and Restated 1987 Partnership Plan, our employee stock purchase plan and our 401(k) retirement plan.(2) Includes shares underlying stock options exercisable currently or within 60 days of April 23, 2003. (3) Phantom stock units, each representing the value of one share of our common stock, are attributable to accounts in our Deferred Compensation Plan for Non-Employee Directors. The participants in the plan do not have voting or investment power with respect to these units. (4) Includes 120,000 shares held by Mr. Goldfus’ wife, as to which he disclaims beneficial ownership. (5) Excludes shares held by the Russell H. Baumgardner Trust dated June 6, 1986, which are deemed to be beneficially owned by Messrs. Goldfus and Niederhofer because they share voting and investment power as

trustees of the Trust. As of March 31, 2002, 1,978,645April 23, 2003, 1,773,388 shares were held by the Trust. If these shares were included in thisthe table, the number of shares held by each of Messrs. Goldfus and Niederhofer would be increased by 1,978,645,1,773,388, and the percent of outstanding shares would be as follows: Mr. Goldfus, 9.7%8.9%; Mr. Niederhofer, 8.6%8.1%; and all directors and executive officers as a group, 15.7%16.5%.

3

| (6) | Includes 53,910 shares held by Mr. Huffer’s wife, as to which he disclaims beneficial ownership. |

| (7) | Includes 60,448 shares held by Mr. Niederhofer’s wife, as to which he disclaims beneficial ownership. |

| (8) | Includes 500 shares held by Mr. Stordahl’s wife, as to which he disclaims beneficial ownership. |

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and Our We have no reason to expect that any of the nominees will fail to be a candidate at the annual meeting and, therefore, do not have in mind any substitute or substitutes for any of the nominees. If any of the nominees should be unable to serve as a director, The (7)Includes 500 shares held by Mr. Stordahl's wife, as to which he disclaims beneficial ownership.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCEspecifiedexecutive officers and persons who own more than 10% of a registered class of equityour securities of the Company to file initial reports of ownership of those securities on Form 3 and reports of changes in ownership on Form 4 or Form 5 with the Securities and Exchange Commission. Specific due dates for these reports have been established by the Securities and Exchange Commission, and we are required to disclose in this proxy statement any failure to timely file the required reports by these dates. Based solely on our review of the copies of these reports received by us orand written representations from reporting persons,our directors and executive officers, we believe that duringour executive officers and directors complied with all Section 16(a) filing requirements for the fiscal year ended March 2, 2002, all Section 16(a) filing requirements applicable1, 2003, except for our directors who participated in our Deferred Compensation Plan for Non-Employee Directors. Pursuant to our officers,the terms of the plan, phantom stock units are allocated monthly to bookkeeping accounts established for participating directors under the Deferred Compensation Plan, in lieu of the directors’ annual retainer and greater-than-10% shareholders were compliedmeeting fees, and additional phantom stock units are allocated in connection with in a timely manner.the reinvestment of quarterly dividend equivalents. Directors do not have any control over the timing of the allocation of these units. We elected to report these transactions at one time at the end of the fiscal year rather than within two business days of each allocation, which has been required since August 29, 2002. Accordingly, Mr. Aldrich filed 11 late reports, Mr. Horner filed two late reports, Mr. Richelsen filed 11 late reports and Mr. Shannon filed eight late reports.ItemPROPOSAL 1: ELECTION OF DIRECTORSArticlesarticles of Incorporationincorporation provide that the Board of Directors will be divided into three classes of directors of as nearly equal size as possible andpossible. Our articles further provide that the total number of directors will be determined exclusively by the Board.Board of Directors. The term of each class of director is three years, and the term of one class expires each year in rotation. Currently, there are 1112 directors. TheAt this year’s annual meeting, the terms of our Class II directors will expire. Messrs. Hammerly and Niederhofer, who currently serve as Class II directors with terms expiring at the upcoming annual meeting, will retire at the upcoming annual meeting. In connection with their retirements, our Board of Directors has determined to decrease the number of directors in Class II from five to three. The number of directors in Class I will remain at three, and the number of directors consisting of Barbara B. Grogan, J. Patrick Hornerin Class III will remain at four. Messrs. Aldrich, Edwards and Stephen C. Mitchell, expire atHuffer are the 2002 Annual Meeting of Shareholders. Ms. Grogan and Messrs. Horner and Mitchellcurrent Class II directors who have been membersnominated for re-election to the Board. Mr. Edwards was appointed as a Class II director by the Board on October 31, 2002, effective as of January 16, 2003. Each of the Board since 1996, 1999 and 1996, respectively, and were last electednominees has agreed to the Board at the 1999 Annual Meeting of Shareholders.serve as a director if elected. The terms of the Class II and Class III directors expire at the 2003 and 2004 Annual Meetings of Shareholders, respectively. The affirmative vote of a majority of the shares of common stock of the Company present in person or by proxy and entitled to voteelected at the annual meeting is necessary to elect each nominee.will serve until the 2006 Annual Meeting of Shareholders or until their successors are elected and qualified.(which event is not anticipated), proxies will be voted for a substitute nominee or nominees in accordance with the best judgment of the person or persons acting under the proxies.following table sets forth informationBoard of Directors recommends that you vote FOR the three Class II nominees for director. Unless authority for one or more of the nominees is withheld, proxies will be voted FOR the election of each of Messrs. Aldrich, Edwards and Huffer for a three-year term expiring at the 2006 Annual Meeting of Shareholders. The affirmative vote of the holders of a majority of the shares of our common stock present in person or by proxy and entitled to vote at the annual meeting is required to elect each nominee.

The nominees for election as to each nominee fordirectors and the office of director, as well as for all other directors whose terms of office will continue after the annual meeting have provided the following information about themselves.

Name and Principal Occupation | Age | Director Since | Term Expires | |||

Bernard P. Aldrich (Class II) | 53 | 1999 | 2003 | |||

Robert L. Edwards (Class II) | 47 | 2003 | 2003 | |||

Russell Huffer (Class II) | 53 | 1998 | 2003 | |||

Donald W. Goldfus (Class III) | 69 | 1964 | 2004 | |||

James L. Martineau (Class III) | 62 | 1973 | 2004 |

Name and Principal Occupation Age Director Since Term Expires Ray C. Richelsen (Class III) 61 2000 2004 Michael E. Shannon (Class III) 66 1998 2004 Barbara B. Grogan (Class I) 55 1996 2005 J. Patrick Horner (Class I) 53 1999 2005 Stephen C. Mitchell (Class I) 59 1996 2005

Retired Executive Vice President, Transportation, Graphics and Safety Markets of 3M Company, an industrial, consumer and health care products manufacturer, a position he held from 1999 to 2000. Executive Vice President, Transportation, Safety and Chemical Markets of 3M Company from 1998 to 1999. Various senior management positions with 3M from 1975 through 1998 and other positions with 3M from 1963 to 1974. Mr. Richelsen is also a director of Banta Corporation.

President of MEShannon & Associates, Inc., a consulting firm specializing in corporate finance and investments, since 2000. Chairman of Ecolab Inc., a developer and marketer of premium cleaning, sanitizing and maintenance products and services, from 1996 through 1999. Chief Administrative Officer of Ecolab from 1992 through 1999 and Chief Financial Officer of Ecolab from 1984 through 1999. Mr. Shannon is also a director of CenterPoint Energy, Inc., Clorox Company and NACCO Industries, Inc.

Chairperson and President of Western Industrial Contractors, a construction company specializing in machinery erection and installation, since 1982. Ms. Grogan is also a director of Deluxe Corporation and Pentair, Inc.

Chairman of The Horner Group, an information technology consulting firm, since 1997. President and a director of Management Support Technologies, the lead consulting unit of Condor Technology Solutions, an information technology services company, from 1997 through 1998. Senior Vice President of Intersolv Corporation, an information technology services company, from 1995 to 1997. President, Chief Operating Officer and a director of Perot Systems Corporation, an information technology services company from 1988 to 1992.

President and Chief Operating Officer of The Knight Group, LLC, a privately held professional services company, since 2001. President and Chief Operating Officer of Lester B. Knight & Associates, also a privately held professional services company, from 1975 to 2001.

INFORMATION REGARDING THE BOARD OF DIRECTORS

The Board of Directors conducts its business through meetings of the Board and four standing committees: Audit, Compensation, Corporate Governance and Finance. Each committee member identified below has served on the indicated committee since the 2002 Annual Meeting of Shareholders, is held.

| Name and Principal Occupation | Age | Director Since | Term Expires | |||

|---|---|---|---|---|---|---|

| Barbara B. Grogan (Class I) Chairman of the Board and President, Western Industrial Contractors, a construction company specializing in machinery erection and installation, since 1982. Ms. Grogan is also a director of Deluxe Corporation and Pentair, Inc. Committees: Audit and Corporate Governance | 54 | 1996 | 2002 |

4

J. Patrick Horner (Class I) Chairman of The Horner Group, an information technology consulting firm, since 1997. President and a director of Management Support Technologies, the lead consulting unit of Condor Technology Solutions, an information technology services company, from 1997 through 1998. Senior Vice President of Intersolv Corporation, also an information technology services company, from 1995 to 1997. Prior to joining Intersolv, Mr. Horner held various positions related to information technology services, including five years as President and Chief Operating Officer and a director of Perot Systems Corporation. Committees: Audit and Finance | 52 | 1999 | 2002 | |||

Stephen C. Mitchell (Class I) President and Chief Operating Officer of The Knight Group, LLC, a privately held, professional services company, since 2001. President and Chief Operating Officer of Lester B. Knight & Associates, also a privately held, professional services company, from 1975 to 2001. Committees: Compensation and Corporate Governance | 58 | 1996 | 2002 | |||

Bernard P. Aldrich (Class II) President and Chief Executive Officer of Rimage Corporation, a leading designer and manufacturer of on-demand publishing and duplicating systems for CD-recordable and DVD-recordable media, since December 1996. President of several manufacturing companies controlled by Activar, Inc., an industrial plastics and construction supply company, from January 1995 to December 1996. Mr. Aldrich is also a director of Rimage Corporation. Committees: Audit and Compensation | 52 | 1999 | 2003 | |||

Harry A. Hammerly (Class II) Retired Executive Vice President, International Operations, of 3M Company, an industrial, consumer and health care products manufacturer, a position he held from 1991 to 1995. Prior to that, various senior management positions with 3M since 1973 and other positions with 3M since 1955. Mr. Hammerly is also a director of Milacron, Inc. and BMC Industries, Inc. Committee: Audit | 68 | 1994 | 2003 | |||

Russell Huffer (Class II) Chairman of the Board of Directors of the Company since June 1999 and Chief Executive Officer and President of the Company since January 1998. Prior to 1998, various senior management positions with the Company or our subsidiaries since 1986. Mr. Huffer is also a director of Hutchinson Technology Incorporated. | 52 | 1998 | 2003 | |||

Laurence J. Niederhofer (Class II) Retired Chief Executive Officer of the Company's Wausau Architectural Products Group, a position he held from 1968 to 1993. Committees: Corporate Governance and Finance | 69 | 1964 | 2003 | |||

5

Donald W. Goldfus (Class III) Retired Chairman of the Board of Directors of the Company, a position he held from 1988 to June 1999. Chief Executive Officer of the Company from 1986 to January 1998. President of the Company from 1995 to January 1998. Prior to that, various senior management positions with the Company. Mr. Goldfus is also a director of G&K Services, Inc. and Lifetouch, Inc. Committee: Corporate Governance | 68 | 1964 | 2004 | |||

James L. Martineau (Class III) Retired Executive Vice President of the Company, a position he held from 1996 to 1998. Prior to that, various senior management positions with the Company since 1971. Mr. Martineau is also a director of Pinnacle Entertainment, Inc. Committee: Finance | 61 | 1973 | 2004 | |||

Ray C. Richelsen (Class III) Retired Executive Vice President, Transportation, Graphics and Safety Markets of 3M Company, an industrial, consumer and health care products manufacturer, a position he held from 1999 to 2000. Various senior management positions with 3M from 1975 through 1998 and other positions with 3M from 1963 to 1974. Mr. Richelsen is also a director of Banta Corporation and Rogers Group, Inc. Committee: Compensation | 60 | 2000 | 2004 | |||

Michael E. Shannon (Class III) President of MEShannon & Associates, Inc., a consulting firm specializing in corporate finance and investments, since 2000. Chairman of the Board of Ecolab Inc., a developer and marketer of premium cleaning, sanitizing and maintenance products and services, from 1996 through 1999. Chief Administrative Officer of Ecolab from August 1992 through 1999, Chief Financial Officer of Ecolab from 1984 through 1999. Mr. Shannon is also a director of Minnesota Life Insurance Company, Clorox Company, Pressure Systems, Inc. and RPSI, Inc. Committees: Compensation, Corporate Governance and Finance | 65 | 1998 | 2004 |

with the exception of Mr. Edwards, who was appointed to the Audit and Finance Committees in January 2003. Each committee member will continue to serve on the indicated committee through the 2003 Annual Meeting of Shareholders. The Board of Directors held five meetings during the last fiscal year. The Company has standing Audit, Compensation, Corporate Governance and Finance Committees. The members of the various committees for fiscal 2002 are noted in the previous table. Each member has served on the listed committee since the 2001 Annual Meeting of Shareholders and will continue to serve on the listed committee through the 2002 Annual Meeting of Shareholders. Each director attended more than 75% of the total meetings of the Board and Board committees ofon which the Board of which they were membersdirector served during fiscal 2002.2003.

The Audit Committee is responsible for providing oversight of the financial functions of the Company, including financial reporting and both internal and external auditing efforts (including recommendation of the independent auditors to the Board of Directors), our program to ensure ethical business practices, our system of financial controls and our risk management program. The Audit Committee operates under a written charter. The Audit Committee met eight times during fiscal 2002.

Audit Committee | ||||

Members: | Bernard P. Aldrich Robert L. Edwards Barbara B. Grogan | J. Patrick Horner Michael E. Shannon | ||

The Audit Committee oversees Apogee’s financial reporting process (including our system of financial controls and internal and external auditing efforts), oversees our program to ensure ethical business practices, and assesses and establishes policies and procedures to manage our business and financial risk. The Audit Committee also appoints our independent auditors. The Audit Committee met ten times during fiscal 2003. | ||||

Compensation Committee | ||||

Members: | Bernard P. Aldrich Stephen C. Mitchell | Ray C. Richelsen Michael E. Shannon | ||

The Compensation Committee determines the salary and other compensation of all of our elected officers and senior management. The Compensation Committee also administers our 2002 Omnibus Stock Incentive Plan, 1997 Omnibus Stock Incentive Plan, 1987 Stock Option Plan, Amended and Restated 1987 Partnership Plan and Executive Management Incentive Plan. The Compensation Committee met five times during fiscal 2003. | ||||

Corporate Governance Committee | ||||

Members: | Donald W. Goldfus Barbara B. Grogan Stephen C. Mitchell | Laurence J. Niederhofer Michael E. Shannon | ||

The Corporate Governance Committee periodically assesses the organization’s adherence to our mission and principles, reviews our organizational structure and succession plans, makes recommendations to the Board regarding the composition and responsibilities of Board committees, determines the compensation for directors and annually conducts a review of the performance of Board committees and the Board as a whole. Members of the Corporate Governance Committee also annually review and evaluate the performance of the Chief Executive Officer. In addition, the Corporate Governance Committee recommends new director nominees to the Board and will consider qualified nominees recommended by shareholders. Any recommendations for nominees for the 2004 election of directors should be submitted in writing to our Secretary at the address indicated on the Notice of Annual Meeting of Shareholders no later than February 18, 2004. Recommendations must include the information specified in our bylaws, which will enable the Corporate Governance Committee to evaluate the qualifications of the recommended nominee. You may request a copy of our bylaws by contacting our Secretary at the address indicated on the Notice of Annual Meeting of Shareholders. The Corporate Governance Committee met three times during fiscal 2003. | ||||

The Compensation Committee determines the salary and other compensation of all of our elected officers and senior management. The Compensation Committee also administers our 1997 Omnibus Stock Incentive Plan and the 1987 Partnership Plan and will administer our 2002 Omnibus Stock Incentive Plan

6

and our Executive Management Incentive Plan, if such plans are approved by the shareholders. The Compensation Committee met three times during fiscal 2002.

The Finance Committee reviews significant policies and proposals of management and makes recommendations to the Board with respect to our financial condition and long-range financial objectives, our debt ratio and other financial coverage ratios, appropriate debt limits, the timing and adequacy of proposed financing vehicles, quarterly dividend declarations and the impact of proposed significant transactions on our annual capital budget and financial condition. The Finance Committee met five times during fiscal 2002.

Finance Committee | ||||

Members: | Robert L. Edwards Harry A. Hammerly J. Patrick Horner | James L. Martineau Laurence J. Niederhofer | ||

The Finance Committee reviews significant policies and proposals of management and makes recommendations to the Board of Directors with respect to our financial condition and long-range financial objectives, our debt ratio and other financial coverage ratios, appropriate debt limits, the timing and adequacy of proposed financing vehicles, quarterly dividend declarations, the impact of proposed significant transactions on our annual capital budget and financial condition, and oversees our risk-related insurance program. The Finance Committee met three times during fiscal 2003. | ||||

The Corporate Governance Committee periodically assesses the organization's adherence to our mission and principles, reviews our organizational structure and succession plans, makes recommendations to the Board regarding the composition and responsibilities of Board committees and annually conducts a review of the performance of individual directors and the Board as a whole. Members of the Corporate Governance Committee also annually review and evaluate the performance of the Chief Executive Officer. The Corporate Governance Committee also recommends new director nominees to the Board and will consider qualified nominees recommended by shareholders. Any recommendations for nominees for the 2003 election of directors should be submitted in writing to the Secretary of the Company at the address indicated on the Notice of Annual Meeting of Shareholders no later than February 18, 2003. Recommendations must include the information specified in our Bylaws, which will enable the Corporate Governance Committee to evaluate the qualifications of the recommended nominee. The Corporate Governance Committee met three times during fiscal 2002.

Director Compensation of Directors

Annual Retainer

Our non-employee directors receive an annual retainer of $18,000, plus a fee of $1,000 for each meeting of the Board of Directors or its committees attended.attended either in person or by telephone. The meeting fee for a committeethe chair of the Audit Committee is $2,500 for each Audit Committee meeting chaired. The meeting fee for the chair of the Compensation, Corporate Governance and Finance Committees is $1,500 for each such committee meeting chaired. In the past, non-employeeNon-employee directors also have received automatic, annual stock option grants to purchase 4,000 shares of our common stock under the 1997 Omnibus Stock Incentive Plan. These stock options vest in full six months after the date of grant and have an exercise price equal to the fair market value of our common stock on the date of grant. The table captioned "Security Ownership of Directors and Executive Officers" on page 3 includes the options granted to the non-employee directors in fiscal 2002. The per share exercise price of the options granted in fiscal year 2002 is $10.94.

If the 2002 Omnibus Stock Incentive Plan proposed in Item 2 of this Proxy Statement is approved by shareholders, all future stock option grants for non-employee directors will be granted under the 2002 Omnibus Stock Incentive Plan, and no additional grants will be made under the 1997 Omnibus Stock Incentive Plan. The 2002 Omnibus Stock Incentive Plan provides that, commencing with the 2002 annual meeting, non-employee directors will be awardedreceive both an automatic fixed grant of options to purchase 4,000 shares of our common stock and a variable, dollar-denominated stock option grant such that the total number of shares subject to both types of options will provide our non-employee directors with total dollar-denominated, equity-based compensation equal to the dollar-denominated, equity-based compensation received by non-employee directors in the fiftieth50th percentile of a comparator group of public companies. TheHowever, the total number of shares subject to both types of options granted in any one year may not exceed 10,000 shares per non-employee director. These stock options vest in full six months after the date of grant and have an exercise price of such options will be equal to the fair market value of our common stock on the date of grant,grant. The table captioned “Security Ownership of Directors and Executive Officers” on page 6 includes the options will vest in full six months after the date of grant. For more details regarding the proposed 2002 Omnibus Stock Incentive Plan and the awards to be granted to the non-employee directors under that plan, please see Item 2in fiscal 2003. The per share exercise price of this Proxy Statement.the options granted in fiscal 2003 is $13.10.

Employee Stock Purchase Plan

Non-employee directors also may elect to participate in our Employee Stock Purchase Plan. Underemployee stock purchase plan. During fiscal 2003, under the plan, participants maycould purchase our common stock by contributing up to $200 per week, with the CompanyApogee contributing an amount equal to 15% of each participant'sparticipant’s weekly contribution. We amended our employee stock purchase plan effective as of May 1, 2003 to increase the amounts participants could contribute to the plan to $500 per week. For fiscal 2002, the Company2003, we contributed an aggregate of $2,760$2,880 to the Employee Stock Purchase Planemployee stock purchase plan for the benefit of all non-employee directors as a group.

7

Deferred Compensation Plan

Non-employee directors also may elect to participate in our Deferred Compensation Plan for Non-Employee Directors. This plan was adopted by the Board of Directors in October 1998 and approved at the 1999 Annual Meeting of Shareholders to encourage the non-employee directors to continue to make contributions to the growth and profits of the CompanyApogee and to increase their ownership of shares of our common stock, thereby aligning their interests in the long-term success of the CompanyApogee with that of our other shareholders. Under the plan, participants may defer a portion of their annual retainer and meeting fees into deferred stock accounts. We will match 10% of the elected deferral. Each participating director will receivereceives a credit of shares of our common stock in an amount equal to the amount deferred divided by the fair market value of one share as of the crediting date. These accounts will also beare credited, on each dividend paymentas of the crediting date, inwith an amount equal to the dividend paid on one share of our common stock multiplied by the number of shares credited to each account. Participating directors may elect to receive the amounts credited to their accounts at a fixed date, at age 70 or following death or retirement from the Board of Directors. The amounts will be paid out in the form of shares of our common stock (plus cash in lieu of fractional

shares) either in a lump sum or in installments, and either at a fixed date, at age 70 or following death or retirement from the Board.participating director’s election. This plan is an unfunded, book-entry, "phantom“phantom stock unit"unit” plan as to which no trust or other vehicle has been established to hold any shares of our common stock. For fiscal 2002,2003, we accruedmatched an aggregate of $7,100 for the Company's 10% matching contribution$8,575 in deferrals made by all non-employee directors as a group to the Deferred Compensation Plan for Non-Employee Directors for the benefit of all non-employee directors as a group.Directors.

Until

Consulting Agreement with James L. Martineau

From July 1,1998 until July 2001, we were party to a consulting agreement effective as of July 1, 1998, with Mr. Martineau, a non-employee director, under which Mr. Martineau provided consulting and advisory services to the Company.Apogee. Mr. Martineau'sMartineau’s agreement covered three one-year terms ending July 1, 2001, and provided for the payment to Mr. Martineau of a fee of $250,000 per year, plus certain out-of-pocket expenses and other benefits, including the acceleration to July 1, 1998 of the vesting of a number of previously granted stock options, a payment of $227,200 (payable over three years) to compensate Mr. Martineau for the reduction in value of a number of stock options previously granted to him resulting from his resignation as Executive Vice President of the Company effective as of July 1, 1998, and the reimbursement of medical expenses to Mr. Martineau under our existing medical plans. Mr. Martineau agreed not to compete with the Company during the term of the consulting agreement.2001. We did not renew thisthe consulting agreement in fiscal 2002. However, pursuant to the terms of the consulting agreement, in fiscal 2003, Mr. Martineau received reimbursement of health insurance premiums paid by Mr. Martineau totaling $12,018.

Consulting Agreement with Donald W. Goldfus

We also have entered into a consulting agreement, effective as of June 28, 1999, with Mr. Goldfus, a non-employee director, under which Mr. Goldfus provides consulting and advisory services to the Company.us. Mr. Goldfus'Goldfus’s agreement will remain in effect so long as Mr. Goldfus is a member of our Board of Directors. Under the agreement, Mr. Goldfus has agreed to provide up to 10 hours of consulting services per month to the Companyus in exchange for reimbursement of certain out-of-pocket expenses, office space and related expenses.expenses (which in fiscal 2003 totaled $11,294 for rent and office expenses, $780 for parking expenses, $2,263 for office moving expenses and $2,136 for other covered expenses). For each day during the term of the agreement that Mr. Goldfus provides services to the Companyus in excess of that 10 hours, Mr. Goldfus will receive an additional fee of $1,000 per day. During fiscal 2002, the Company2003, we did not pay Mr. Goldfus any consulting fees. Mr. Goldfus has agreed not to compete with the Companyus during the term of this consulting agreement.

RecommendationEXECUTIVE COMPENSATION

The Board of Directors recommends that you vote FOR the three Class I nominees for director. Unless authority for one or more of the nominees is withheld, proxies will be voted FOR the election of each of Ms. Grogan and Messrs. Horner and Mitchell for a three-year term expiring at the 2005 Annual Meeting of Shareholders.

Compensation Committee Report

Overview and Philosophy

The compensation of executive officers is determined by the Compensation Committee of the Board of Directors. is responsible for:

| Ÿ | establishing compensation programs that comply with our compensation philosophy; |

| Ÿ | determining the compensation of Apogee’s executive officers and other members of senior management; |

| Ÿ | administering Apogee’s omnibus stock incentive plans; and |

| Ÿ | administering Apogee’s individual cash incentive plans for executive officers and other members of senior management. |

The Committee is comprised entirely of non-employee directors.operates under a written charter, which we annually review. To assist in performing itsour duties and to enhance itsour objectivity and independence, the Committee has authority to and periodically obtains advice and recommendations offrom an outside compensation consultant and reviews independent compensation data from other companies of similar size and complexity.

The Committee is composed entirely of non-employee directors, all of whom are independent in accordance with current NASDAQ listing standards. During fiscal 2003, the members of the Committee were Messrs. Aldrich, Mitchell, Richelsen and Shannon.

Philosophy

In establishing our objectives for executive compensation, the Committee desires to preserve the entrepreneurial style that we believe forms a strong component of Apogee’s history, culture and competitive advantage and to emphasize long-term business development and creation of shareholder value. Therefore, a significant portion of total compensation is performance-based.

The objectives of our executive compensation program are to:

| Ÿ | Promote the achievement of strategic objectives that the Board believes will lead to long-term growth in shareholder value; |

| Ÿ | Attract and retain high-performing executive officers by rewarding outstanding performance and offering total compensation that is competitive with that offered by similarly situated companies; and |

| Ÿ | Align the interests of executive officers with those of Apogee and our shareholders by making incentive compensation largely dependent upon the achievement by our business units or Apogee as a whole of specified performance goals. |

In fiscal year 2002,2003, with the assistance of an independent outside compensation consultant, the Committee performed a comprehensive analysis of executive compensation using independent compensation data from companies of similar size and complexity, and reviewed the Company'sour executive compensation system and practices. The Committee concluded that no major changes to the Company'sour compensation system or practices were required in order to enable the Committeemanagement to properly to perform itstheir functions for the Company.

In administering the executive compensation plans, the Committee desires to preserve the entrepreneurial style that it believes forms a strong component of the Company's history, culture and competitive advantage and to emphasize long-term business development and creation of shareholder value. Therefore, a significant portion of total compensation is performance-based.

The objectives of the executive compensation policies are to:

Base Salary

Base

The Committee annually reviews the base salaries are reviewed annually.of our executive officers. In determining an executive's annualexecutive officer’s base salary, the Committee takes into account the executive'sexecutive officer’s level of responsibility, experience and performance in relation to that of the CompanyApogee and similar companies. Base salaries generally are generally targeted to be at the median of executive base salaries for companies of similar size and complexity. Based on the results of the independent compensation survey commissioned by the Committee in fiscal 2002,2003, the base salaries of our executive officers for fiscal 20022003 generally were generally nearsomewhat above the average base salaries of executive officers in similar positions for comparable companies. It is the Committee’s policy to bring the base salaries back to the 50th percentile over time.

Annual Incentives

Executives

Executive Management Incentive Plan

At the 2002 Annual Meeting, our shareholders approved the Executive Management Incentive Plan (the “Executive MIP”), an incentive compensation program in which our executive officers may participate, at the discretion of the Committee. The Executive MIP provides participating executive officers with annual incentive awards based on the attainment of one or more predetermined, objective performance goals during a particular fiscal year. These goals are established by the Committee no later than 90 days after the beginning of a fiscal year. The goals may apply to the individual officers participating in the Executive MIP, an identifiable business unit or Apogee as a whole, or any combination thereof, and must be based on one or more of the following business criteria:

| Ÿ | earnings (whether before or after taxes); |

| Ÿ | cash flow (including free cash flow and cash flow from operating, investing or financing activities or any combination of these measures); |

| Ÿ | earnings per share (basic or diluted); and |

| Ÿ | total shareholder return or profitability, or both, as measured by one or more of the following accounting ratios: return on revenue, return on assets, return on equity, return on invested capital and return on investments. |

For our chief executive officer, the target and potential range of annual bonus awards under the Executive MIP may be between zero and 150% of the chief executive officer’s annual base compensation. For our executive vice presidents, chief financial officer and general counsel, the target and potential range may be between zero and

100% of the participant’s annual base compensation. For other participants, the Committee has discretion to establish targets and ranges. The maximum bonus that may be paid to any participant pursuant to the Executive MIP in any fiscal year is $1,500,000. The Committee has complete discretionary authority to reduce the amount of a bonus that otherwise would be payable to any participant under the Executive MIP. The incentive award is payable in the form of cash or stock. Participants are entitled to defer part or all of an annual bonus payment under Apogee’s deferred compensation plans.

For fiscal 2003, only Mr. Huffer participated in the Executive MIP, and all annual incentive awards granted to Mr. Huffer for fiscal 2003 were made under the Executive MIP. See “Chief Executive Officer Compensation” on page 15.

Individual Cash Bonus Plans

Executive officers who are not selected by the Committee to participate in the Executive MIP during a particular fiscal year may earn annual incentive compensation under individualized cash bonus plans. At the beginning of each fiscal year, the Committee develops the plan for the Company's Chairman, President and Chief Executive Officer, and reviews and approves plans presented by the Chief Executive Officerchief executive officer for the other executive officers. Each plan contains specific financial objectives, such as business unit and/or Company profitability, the profitability of Apogee as a whole, and return on invested capital, and may include specific objectives for business, organizationorganizational and personal development. For fiscal 2003, the objectives set focused primarily on savings from Six Sigma activities, employee safety metrics and revenue growth. The Committee then evaluates each executive officer with respect to his or her financial targets and non-financial performance objectives. The Committee'sCommittee’s policy is to pay a bonus to an executive officer only when the financial performance thresholds applicable to that executive officer have been met. The Committee also may reward executivesexecutive officers for meeting thetheir non-financial objectives. Exceeding all of the annual financial and non-financial objectives usually provides the executive officer with

9

the opportunity to earn total cash compensation (base salary and annual incentives) in the upper quartile of that paid by companies of similar size and complexity. For fiscal 2002,2003, the range of bonus payments to executivesexecutive officers as a percentage of base pay ranged from 19%33% to 124%76%.

If the Executive Management Incentive Plan proposed in Item 3 of this Proxy Statement is approved by the shareholders, it will replace the annual incentive plans for those executive officers who participate in the Executive Management Incentive Plan. For fiscal 2003, only Mr. Huffer has been designated to participate in the Executive Management Incentive Plan, if approved by the shareholders. In that case, any annual incentive awards granted to Mr. Huffer for fiscal 2003 will be made under the Executive Management Incentive Plan.

Long-Term Incentives

Partnership Plan.Plan

To further align the interests of executive officers with those of our shareholders, eligible employees, including our executive officers, selected by the Committee also may participate in the Company'sour Amended and Restated 1987 Partnership Plan. AtUnder the Partnership Plan, prior to the beginning of each fiscal year, each participant may voluntarilyelect to defer up to 50% of his or herany annual incentive compensation (either cash or shares of our common stock) that may be earned by the participant with respect to that fiscal year, for a period of time selected by the participant (but that generally must be at least five years from the date of deferral). There is no maximum dollar limit on the amount that may be deferred each year. The deferred cash amounts are invested in shares of Companyour common stock understock. Although all shares in the Partnership Plan. The Company matchesparticipant’s account vest immediately, they are restricted in that they are held in trust for the benefit of the participant during the deferral period and may not be transferred by the participant during the deferral period.

We match 100% of the deferred amount in the form of restricted shares of Companyour common stock. The amount contributed by the participant vests immediately, but therestricted shares are restricted and are held in trust and deferred for a period of time selected by the participant (generally at least five years from the date of deferral). In fiscal 2002, the amount deferred by any individual was limited to $100,000. At the 2001 Annual Meeting of Shareholders, our shareholders approved an amendment to the Partnership Plan that eliminated this $100,000 limit on amounts deferred for fiscal years beginning after 2002.

The Company match is made in the form of restricted stock that vestsvest in equal, annual increments over periods ranging from one to 10 years, as determined by the Committee. In the table entitled "Summary“Summary Compensation Table" below,Table” on page 16, the deferred amount and the Companyour match are shown in the column labeled "Restricted“Restricted Stock Awards."” No other restricted stock grants have been made to executive officers in the three-year period covered by the Summary Compensation Table.

The Partnership Plan is described in more detail in Proposal 2 set forth in this proxy statement.

Stock Incentive Plan.Plans Executives

Executive officers are also eligible to receive grants under the Company'sour omnibus stock incentive plan, which is administered byplans. Stock options granted to our chief executive officer are based on the Committee. Nearly allBoard’s evaluation of his performance against certain agreed upon objectives. For other officers, grants are related to performance and the competitiveness of the total compensation package.

During fiscal 2003, stock option grants prior to fiscal 1999executive officers were made under the Company's 1987 Stock Option Plan. This plan expired by its terms on April 25, 1997, and no additional grants may be made thereunder. Option grants since that date have been made under the Company's shareholder-approvedboth our 1997 Omnibus Stock Incentive Plan. However, as of April 24, 2002, only 249,359 shares were available for future stock option grants under the 1997 Plan. In order for the Company to continue to award stock options as long-term incentives to key managementPlan and other employees, on April 11, 2002, the Committee recommended, and the Board of Directors adopted, the Company's 2002 Omnibus Stock Incentive Plan. This plan is being presented for approval by the shareholders at the 2002 Annual Meeting of Shareholders as Item 2 of this Proxy Statement. If Item 2 is approved by the shareholders, stock option grants to executives will be made under both theour 2002 Omnibus Stock Incentive Plan, both of which were shareholder-approved and are administered by the Committee.

Under both the 1997 and the 1997 Omnibus Stock Incentive Plan until such time as2002 plans, the shares authorized for issuance underexercise price of any options granted must equal or exceed the 1997 Omnibus Stock Incentive Plan have been exhausted. Thereafter, stock option grants to executives will be made under the 2002 Omnibus Stock Incentive Plan.

Under any of these stock incentive plans, option grants may be made only at or above current market pricesprice of our common stock so thaton the date the option is granted. As a result, the value of the options to the executive rewards will accrueofficers increases only as shareholder value increases. The options granted under the 1987 Stock Option Plan typically vested at a rate of 25% per year beginning on the grant's first anniversary, although some grants made in fiscal 1997 vested entirely from 32 to 48 months after grant. Options granted under the 1997 Omnibus Stock Incentive Planplan typically vest incrementally over three to five years from the grant date. Options granted under the 2002 plan typically vest incrementally over two to five years from the grant date. The table below entitled "Option“Option Grants in Last Fiscal 2002"

10

Year” on page 18 indicates option grants made during fiscal 20022003 to the executive officers named in the Summary Compensation Table. Option grants have generally been made to a broad base of participants that includes employees at various levels of management, both at the corporate office and at the business units.

Chief Executive Officer Compensation

Mr. Huffer assumed the position of Chief Executive Officer in January 1998. His base salary was adjustedincreased by the Committee in April 2001May 2002 to $580,000 to reflect his successful performance and make his salary more competitive with$600,000. Annually, the salaries ofBoard analyzes our chief executive officers of comparable companies.officer against agreed-upon objectives. This evaluation is a primary criterion used by the Committee in determining the appropriate pay level for our chief executive officer. His base salary leaves Mr. Huffer slightly belowat the median base pay level for chief executive officers of similar companies, as determined by the recent survey commissioned from our independent outside compensation consultant.companies. As previously noted, Mr. Huffer participated in the Executive MIP for fiscal 2003, and he met or exceeded all of the financial and non-financial performance targets established at the beginning of fiscal 20022003 for determination of his annual incentive bonus award.award under the Executive MIP. For fiscal 2003, the performance targets established were based on earnings per share and return on invested capital. Accordingly, the Committee awarded Mr. Huffer a bonus of $722,000$452,896 under his annual incentive plan.the Executive MIP. The sum of Mr. Huffer'sHuffer’s base salary and annual incentive bonus is in the topthird quartile of compensation for similar officers in comparable companies as determined by the independent compensation consultant market survey. Prior to fiscal 2002,2003, Mr. Huffer elected to defer under our Partnership Plan 50% of any potential bonus received under the 1987 Partnership Plan (subjectannual incentive compensation earned by him with respect to the $100,000 limitation for fiscal 2002). Therefore, the accompanying Summary Compensation Table reflects a cash bonus of $622,000.2003. The deferred portion of Mr. Huffer'sHuffer’s bonus, as well as the Companyour match described above under “Partnership Plan,” are reported in the Restricted Stock Award column in that table.the Summary Compensation Table, with the remainder of his annual incentive compensation reported in the Bonus column of the Summary Compensation Table.

In fiscal 2002,

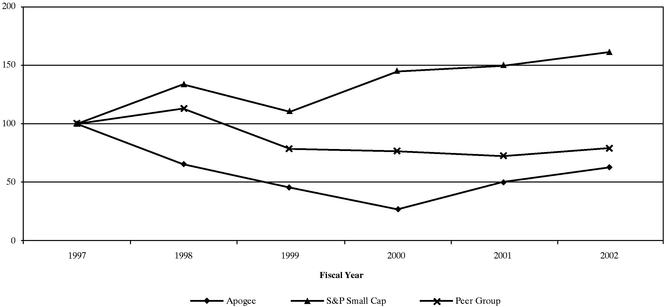

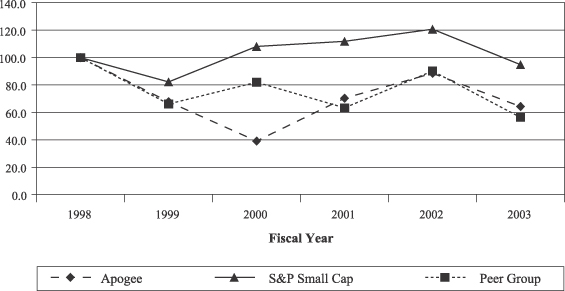

Mr. Huffer was granted stock options in April 2002 and June 2002 to purchase 80,000an aggregate of 8,010 and 71,990 shares of the Company'sour common stock, at $8.60respectively. The exercise price of the April option grant is $12.84 per share, and the exercise price of the June option grant is $13.10 per share, in each case representing the fair market value of our common stock on the date of grant. The Committee determined that this grant would be appropriate based on Mr. Huffer's successful performance and the desire of the Committee to provide a total compensation package competitive with chief executive officers of similar companies. ThisApril option was granted under the terms of the 1997 Omnibus Stock Incentive Plan. In April 2002, Mr. Huffer was granted stock options to purchase 8,010 shares of our common stock at $12.84 per share,Plan, and the fair market value of our common stock on the date of grant. ThisJune option was granted under the terms of the 19972002 Omnibus Stock Incentive Plan. During the second quarter of fiscal 2003, the Committee intends to grant Mr. Huffer an option for approximately 71,990 additional shares at the fair market value of our common stock on the date of grant. This option, if granted, will be granted under the terms of our 1997 Omnibus Stock Incentive Plan or our 2002 Omnibus Stock Incentive Plan, if approved, as determined by the Committee. The Committee determined that these two grants would bewere appropriate, when combined with the annual bonus targets established for Mr. Huffer for fiscal 2003, to providebased on the Board’s annual evaluation of Mr. Huffer with the right incentives to lead the Company to achieve necessary improvements in operating and financialagainst his agreed upon performance which the Board is expecting in fiscal 2003.objectives. In making these decisions,grants, the Committee took into consideration that Mr. Huffer will only receive benefitsbenefit from this grantthe options if he achieves significant improvements for the Company,Apogee, and that Mr. Huffer'sHuffer’s total compensation will be competitive with chief executive officers of similar companies.